Exhibit (a)(5)(F)

UNITED STATES DISTRICT COURT

WESTERN DISTRICT OF WASHINGTON

AT SEATTLE

|

KARAN JUGAL, Individually and on Behalf of All Others Similarly Situated,

Plaintiff,

v.

ZULILY, INC., DARRELL CAVENS, MARK VADON, W. ERIC CARLBORG, JOHN GESCHKE, MIKE GUPTA, YOUNGME MOON, MICHAEL POTTER, SPENCER RASCOFF, LIBERTY INTERACTIVE CORPORATION, MOCHA MERGER SUB, INC., and ZIGGY MERGER SUB, LLC,

Defendants. |

Case No.

CLASS ACTION COMPLAINT FOR VIOLATION OF SECTIONS 14(d)4 , 14(e) AND 20(a) OF THE SECURITIES EXCHANGE ACT OF 1934 AND 17 C.F.R. § 240.14d-9

JURY TRIAL DEMANDED

|

Karan Jugal (“Plaintiff”), on behalf of herself and all others similarly situated, by her attorneys, alleges the following upon information and belief, except as to those allegations specifically pertaining to Plaintiff and her counsel, which are made on personal knowledge, based on the investigation conducted by Plaintiff’s counsel. That investigation included reviewing and

1

analyzing information concerning the proposed acquisition of all the outstanding stock of zulily, Inc. (“zulily” or the “Company”) by Liberty Interactive Corporation (“Liberty”), which Plaintiff (through her counsel) obtained from, among other sources: i) publicly available press releases, news articles, and other media reports; ii) publicly available financial information concerning zulily; and iii) filings with the U.S. Securities and Exchange Commission (“SEC”) made in connection with the Proposed Transaction (defined below).

NATURE OF THE CASE

1. This is a stockholder class action on behalf of the holders of the common stock of zulily, against zulily, the members of the board of directors of zulily (the “Individual Defendants” or “Board”), Liberty, and its wholly owned subsidiaries Mocha Merger Sub, Inc. (“Purchaser”) and Ziggy Merger Sub, LLC (“Merger Sub 2” and together with Purchaser, the “Merger Subs”), for their violations of Sections 14(d)(4) , 14(e) and 20(a) of the Securities Exchange Act of 1934 (the “Exchange Act”), 15 U.SC. §§ 78n(d)(4),78n(e), 78t(a), and SEC Rule 14d-9, 17 C.F.R. §240.14d-9(d) (“Rule 14d-9”).

2. Defendants have violated the above-referenced Sections of the Exchange Act by causing a materially incomplete and misleading Schedule 14D-9 Solicitation/Recommendation Statement (“Recommendation Statement”) to be filed with the SEC on September 1, 2015. The Recommendation Statement recommends that zulily stockholders tender their shares pursuant to the terms of a tender offer (the “Tender Offer”), whereby Liberty seeks to acquire all the outstanding shares of common stock of zulily for a combination of cash and stock consideration valued at $18.75 per share.

3. Zulily is a Delaware corporation that maintains its principal executive offices in

2

Seattle, Washington. The Company is an online retailer that focuses on selling merchandise to moms purchasing for their children, themselves, and their homes. The Company offers its products through a flash sales model using its desktop and mobile websites and mobile applications.

4. Since its inception in 2010, zulily has emerged as a destination brand for millions of millennial customers, becoming the third fastest retailer in history (along with Amazon and Old Navy) to reach $1 billion in annual net sales. While the Company’s stock went public at $22 per share in November 2013 and skyrocketed to $73.50 in February 2014, the Company’s stockholders now stand to receive consideration valued at only $18.75 a share.

5. On August 17, 2015, zulily and Liberty jointly announced that they had reached a definitive Agreement and Plan of Reorganization (“Reorganization Agreement”) pursuant to which Purchaser will commence an exchange offer (the “Tender Offer”) to acquire all of zulily’s outstanding common stock for consideration comprised of: (i) $9.375 per share of zulily common stock in cash (the “Cash Consideration”), and (ii) 0.3098 of a share of Liberty’s Series A QVC Group Common Stock, plus cash in lieu of any fractional shares (the “Stock Consideration” and together with the “Cash Consideration,” the “Transaction Consideration”).

6. In order to preserve the qualification of the Tender Offer and the Proposed Transaction (defined below) as a “reorganization” under the Internal Revenue Code, the Cash Consideration may be decreased and Stock Consideration may be increased by the number of shares (or fraction of a share) of Liberty’s Series A QVC Group Common Stock such that, after such adjustment, the aggregate value of the Stock Consideration will be equal to approximately 43% of the value of the Transaction Consideration.

3

7. If the conditions to the Tender Offer are satisfied and the Tender Offer closes, Liberty would acquire any remaining zulily shares pursuant to a merger of Purchaser with and into zulily (the “First Merger”), with zulily surviving the First Merger. Immediately following the First Merger, zulily, as the surviving corporation of the First Merger, will be merged with and into Merger Sub 2 (the “Second Merger” and, together with the First Merger, the “Proposed Transaction”), with Merger Sub 2 surviving the Second Merger as a direct, wholly owned subsidiary of Liberty. The Reorganization Agreement contemplates that the First Merger will be effectuated pursuant to Section 251(h) of the General Corporation Law of the State of Delaware, which permits completion of the First Merger upon the acquisition of a majority of the voting power of zulily common stock. Accordingly, no vote of zulily’s stockholders will be required in connection with the First Merger if Liberty and Purchaser consummate the Tender Offer. Zulily and Liberty intend, for U.S. federal income tax purposes, that the Tender Offer and the Proposed Transaction, taken together, will qualify as a “reorganization” within the meaning of Section 368(a) of the Internal Revenue Code of 1986.

8. The Tender Offer commenced on September 1, 2015, and is scheduled to expire at midnight, Eastern Time, on September 29, 2015.

9. Both the Transaction Consideration and the process by which Defendants have agreed to consummate the Proposed Transaction are fundamentally unfair to zulily’s public stockholders. Indeed, the value of the Transaction Consideration is 53% lower than the Company’s 52 week high closing price of $39.68, 15% below the $22 initial public offering (“IPO”) price of the Company’s common stock in November 2014, and 74% less than the Company’s February 2014 high of $72.75. The Company’s stock price closed above the implied

4

value of the Transaction Consideration as recently as February 2015. Simply put, the Proposed Transaction will provide no premium at all to any zulily stockholder who acquired their shares on the public market between the Company’s November 2013 IPO and late-January 2015.

10. Further, several analysts have recently set price targets for the Company significantly above the implied value of the Transaction Consideration. Specifically, analysts from Stifel, Goldman Sachs and Janney Montgomery Scott LLC issued price targets of $25, $23 and $22 per share, respectively, on February 12, 2015. And an analyst from Lebenthal & Co. issued a price target of $53 per share within the past twelve months.

11. The Transaction Consideration zulily stockholders stand to receive is particularly inadequate given the significant benefits Liberty will reap if the Proposed Transaction is consummated. The purchase will enable Liberty’s home shopping and ecommerce retailer subsidiary QVC, Inc. (“QVC”) to tap into zulily’s younger demographic of “millennial moms.” This benefit alone, which an analyst from Stifel Nicolaus & Co. described as “a millennial-focused feeder program stabilizing the future QVC,” combined with the significant synergies expected from the Proposed Transaction, caused a Forbes contributor to write that “Liberty and QVC swooped in and got themselves a deal.”(1)

12. The inadequate Transaction Consideration appears to be the result of a sale process that was motivated by the self-interest of certain zulily insiders and private equity firms that are eager to exit on their investment in the Company.

13. If the Proposed Transaction is consummated, zulily’s co-founders and current Board members Mark Vadon (“Vadon”) and Darrell Cavens (“Cavens”) will collectively make

(1) Charley Blaine, 3 Facts you Might Have Missed In QVC’s Buyout Of Zulily, FORBES (Aug. 20, 2015), http://www.forbes.com/sites/charleyblaine/2015/08/20/3-facts-you-might-have-missed-in-qvcs-buyout-of-zulily/.

5

over $1 billion. Vadon holds 34 million shares of zulily himself, and 25 million shares through a limited liability company called Lake Tana, according to SEC filings. He also has an additional 1.1 million shares in an investment arm called Vadon Holdings. Accordingly, Vadon will bring in more than $648 million as a result of the Proposed Transaction. Cavens holds more than 21 million shares, which makes his stake in the Company worth $394 million.

14. Vadon and Cavens, by virtue of their significant holdings of zulily’ s Class B common stock, own shares representing approximately 90% of the voting power of zulily’s outstanding capital stock. The Company’s Class B common stock has ten votes per share, whereas its Class A common stock has only one vote per share. Given the greater number of votes per share attributed to the Class B common stock, the significant holders of Class B common stock, namely Vadon and Cavens, control a majority of the voting power even though their stock holdings represent as few as approximately 9.1% of the outstanding number of shares of the Company’s common stock.

15. As of December 28, 2014, the holders of Class B common stock, including Vadon, Cavens and other zulily executive officers and directors, collectively owned shares representing approximately 91.3% of the voting power of the Company’s outstanding capital stock. The concentrated control of voting power amongst Company insiders limits the ability of zulily’s public stockholders to influence corporate matters, and allowed the Board to make strategic decisions that are not aligned with their interests. For example, Vadon and Cavens were able to control elections of directors, amendments of the Company’s certificate of incorporation and bylaws, increases to the number of shares available for issuance under the Company’s equity compensation plans, adoption of new equity compensation plans, and approval of any merger or

6

sale of assets.

16. In order to lock up the Proposed Transaction, both Cavens and Vadon have entered into a tender and support agreement (the “Tender and Support Agreement”), pursuant to which they have agreed, among other things, to: (i) tender all of the their shares in the Tender Offer, or (ii) in the event of an Adverse Recommendation Change (as defined in the Reorganization Agreement), tender their shares which in the aggregate represent 34.99% of the outstanding voting power of the Company.

17. According to an investor presentation announcing the Proposed Transaction, as a result of the Tender and Support Agreement, only 9.5% of zulily’s shares not owned by Cavens or Vadon need to be tendered in the Tender Offer in order for the Proposed Transaction to be completed. Thus, the Proposed Transaction has been virtually locked up by two Board members who stand to reap significant personal gain if the deal is completed.

18. The Proposed Transaction is also fait accompli because Vadon and Cavens undoubtedly have the support of two of zulily’s biggest early investors - private equity firms Andreessen Horowitz and Maveron Equity Partners (“Maveron”). Maveron has direct ties to the Board, as one of its cofounders and partners, Dan Levitan (“Levitan”), was a zulily director until February 2014.

19. The relationship between Maveron and Vadon has continued since Levitan left the Board, as Maveron made an in-kind distribution of 5,642 shares of Class A Common Stock to Vadon on May 8, 2015. Further, according to a recent SEC filing, Vadon has an unspecified economic interest in Maveron Equity Partners IV, L.P. and Maveron General Partner IV LLC.

20. The economic interests’ of Maveron and Andreessen Horowitz undoubtedly

7

influenced the Board’s sale process, as their willingness to invest in zulily were critical components to the Company’s early growth. But private equity firms are eager to cash out on their investments and return capital to their investors. Accordingly, the interests of Maveron and Andreessen Horowitz are not aligned with zulily’s other public stockholders because both firms acquired a significant portion of their zulily shares below market price.

21. Andreessen Horowitz will net about $78 million in cash and stock before taxes, assuming a cost basis of about $8.30 a share. Maveron has been selling shares since the Company’s IPO but still had 5.7 million shares as of February. At $18.75 per share, its stake is worth about $107.1 million, almost all of it capital gain.

22. Andreessen Horowitz and certain affiliated entities collectively own 13.2% of zulily’s Class B Common Stock, giving them 11.8% of the Company’s total voting power.

23. The sale process was also tainted by a material conflict of interest faced by Individual Defendants Cavens, Vadon and members of zulily management. Specifically, Cavens, Vadon and other Company officers will keep their positions following the consummation of the Proposed Transaction. Cavens will remain President and CEO of zulily, while Vadon will join the Liberty Interactive Board of Directors.

24. Further, certain Company officers will keep their lucrative management positions after the Proposed Transaction closes. Bob Spieth, zulily’s Chief Operating Officer, and Lori Twomey, the Company’s Chief Merchant, will both stay on with the combined company. Both Spieth and Twomey were involved in the strategic review process and present at various Board meetings during which the Company’s strategic alternatives, including the Proposed Transaction, were discussed, and thus undoubtedly influenced the Board’s decision making process.

8

25. Compounding the failure to obtain adequate consideration for zulily’s stockholders, Defendants also agreed to unreasonable deal-protection provisions in the Reorganization Agreement that unfairly favor Liberty and discourage other potential bidders from submitting a superior offer for zulily. These preclusive devices include: (i) a strict non-solicitation provision that restricts the Board from soliciting other potentially superior offers; (ii) an “information rights” provision, which provides Liberty with unfettered access to information about other potential proposals, gives Liberty four business days to negotiate a new deal with zulily in the event a competing offer emerges, and provides Liberty with the perpetual right to attempt to match any superior bid; and (iii) a termination fee of $79 million.

26. As discussed below, the consideration zulily’s stockholders stand to receive in connection with the Tender Offer and the process by which Defendants propose to consummate the Proposed Transaction are fundamentally unfair to Plaintiff and the other common stockholders of the Company. Defendants have now asked zulily stockholders to tender their shares for inadequate consideration based upon the materially incomplete and misleading representations and information contained in the Recommendation Statement, in violation of Sections 14(d)(4), 14(e), and 20(a) of the Exchange Act. Specifically, the Recommendation Statement contains materially incomplete and misleading information concerning: i) the financial analyses performed by the Board’s financial advisor, Goldman Sachs & Co. (“Goldman Sachs”) to support its fairness opinion, including key inputs and financial projections; ii) the basis for the decision of Company management and the Board to suddenly revise financial projections management had initially prepared in May 2015 downward in July 2015, which had a material impact on the valuation ranges Goldman Sach’s calculated in connection with the financial analyses it performed to

9

support its fairness opinion; and iii) Goldman Sachs’ relationship with Liberty, zulily and certain of their respective affiliated entities, which likely tainted the sale process and rendered Goldman Sach’s incapable of rendering an impartial fairness opinion.

27. For these reasons and as set forth in detail herein, Plaintiff seeks to enjoin Defendants from taking any steps to consummate the Tender Offer and Proposed Transaction unless and until the material information discussed below is made available to zulily’s stockholders, or, in the event the Tender Offer and Proposed Transaction are consummated, to recover damages resulting from the Individual Defendants’ violations of the Exchange Act.

JURISDICTION AND VENUE

28. The claims asserted herein arise under Sections 14(d),14(e), and 20(a) of the Exchange Act, 15 U.S.C. §78n. The Court has subject matter jurisdiction pursuant to Section 27 of the Exchange Act, 15 U.S.C. §78aa, and 28 U.S.C. §1331.

29. This Court has personal jurisdiction over all of the Defendants because each is either a corporation that conducts business in and maintains operations in this District or is an individual who either is present in this District for jurisdictional purposes or has sufficient minimum contacts with this District so as to render the exercise of jurisdiction by this Court permissible under traditional notions of fair play and substantial justice.

30. Venue is proper in this District under Section 27 of the Exchange Act, 15 U.S.C. §78aa, as well as pursuant to 28 U .S.C. §1391 because zulily maintains its principle executive offices in this District, each Defendant transacted business in this District, and a substantial part of the events or omissions giving rise to Plaintiff’s claims occurred in this District.

10

PARTIES

31. Plaintiff is, and at all relevant times has been, a stockholder of zulily since prior to the wrongs complained of herein.

32. Defendant zulily is incorporated under the laws Delaware and maintains its principle executive offices in Seattle, Washington.

33. Individual Defendant Darrell Cavens is one of zulily’s co-founders, and has served as the Company’s President, Chief Executive Officer and a member of the Board since October 2009. From July 2008 to October 2009, Cavens served as a director at Microsoft Corporation. From 1999 to 2008, Cavens held various positions at Blue Nile, an online jewelry retailer. From 1996 to 1999, Cavens served as a staff engineer at Starwave Corp., a software and website company that merged with InfoSeek Corporation, an internet search and navigation company, and was later acquired by The Walt Disney Company. Cavens is a citizen of Washington.

34. Individual Defendant Mark Vadon is one of zulily’s co-founders, has served as Chairman of the Board since October 2009, and has been an employee of the Company since July 2013. From 1999 to February 2008, Vadon was Chief Executive Officer of Blue Nile, which he founded in 1999. Vadon also served as Chairman of the board of directors of Blue Nile from 1999 to December 2013. From 1992 to 1999, Vadon was a consultant for Bain & Company, a management consulting firm. Vadon is also on the board of directors of The Home Depot Inc. Vadon is a citizen of Washington.

35. Individual Defendant W. Eric Carlborg (“Carlborg”) has served as a member of the Board since October 2011. Since June 2010, Carlborg has served as a partner at August Capital, a venture capital firm. From April 2006 to June 2010, Carlborg served as a partner at Continental Investors LLC, an investment company. From 2005 to 2006, Carlborg served as Chief Financial

11

Officer of Provide Commerce, Inc., an e-commerce company. From 2001 to 2004, Carlborg was a managing director of investment banking with Merrill Lynch & Co. Carlborg previously served on the board of directors of Big Lots, Inc., a discount chain of retail stores, and Blue Nile, Inc. Carlborg is currently on the board of directors of various privately held companies. Carlborg is a citizen of California.

36. Individual Defendant John Geschke (“Geschke”) has served as a member of the Board since February 2014. Since July 2012, Geschke has served as Senior Vice President, General Counsel and Secretary of Zendesk, Inc., a software development company. From April 2010 to June 2012, Geschke served as General Counsel of Norwest Venture Partners, a venture capital firm. From March 1996 to April 1998 and from May 1999 to March 2010, Geschke practiced law at Cooley LLP. Geschke is a citizen of California.

37. Individual Defendant Mike Gupta (“Gupta”) has served as a member of the Board since January 2015. Since September 2014, Gupta has served as Senior Vice President of Strategic Investments at Twitter, Inc. Prior to that, Gupta served as Chief Financial Officer of Twitter from December 2012 to August 2014 and as Vice President of Corporate Finance and Treasurer from November 2012 to December 2012. From May 2011 to November 2012, Gupta served in two roles at Zynga Inc., an online provider of social game services, including as Senior Vice President and Treasurer. From February 2003 to May 2011, Gupta served in several roles at Yahoo! Inc. Gupta is a citizen of California.

38. Individual Defendant Youngme Moon (“Moon”) has served as a member of the Board since July 2013. Moon is currently a dean and professor at Harvard Business School, where he joined the faculty in June 1998. From 1997 to 1998, Moon was a professor at the

12

Massachusetts Institute of Technology. Moon is a citizen of Massachusetts.

39. Individual Defendant Michael Potter (“Potter”) has served as a member of the Board since March 2011. From October 2011 to March 2012, Potter served as zulily’s Chief Operating Officer. From 1991 to 2005, Potter held various positions with Big Lots, most recently serving as Chairman, President and Chief Executive Officer. Potter previously served on the board of directors of Newegg Inc., an online retailer, Coldwater Creek Inc., a retailer of clothing and household goods, and Big Lots. Potter also currently serves on the board of directors of Blue Nile. Potter is a citizen of Oregon.

40. Individual Defendant Spencer Rascoff (“Rascoff”) has served as a member of the Board since June 2013. Since September 2010, Rascoff has been the Chief Executive Officer of Zillow, Inc., a provider of real estate and home-related information marketplaces. From 2003 to 2005, Rascoff served as Vice President of Lodging for Expedia, Inc., an online travel company. In 1999, Rascoff co-founded Hotwire, Inc., an online travel company, and managed several of Hotwire’s product lines before Hotwire was acquired in 2003 by IAC/InterActiveCorp, Expedia’s parent company at the time. Rascoff is also on the board of directors of Zillow, Julep Beauty Incorporated, an online beauty brand company, and TripAdvisor Incorporated, a travel services company. Rascoff faced conflicts of interest as a result of his various board positions, and was thus purportedly required to recuse himself from discussions and deliberations of the Board regarding the Proposed Transaction. Rascoff is a citizen of Washington.

41. Defendant Liberty Interactive Corporation is a Delaware corporation and maintains its principal executive offices in Englewood, Colorado. Liberty operates and owns interests in a broad range of digital commerce businesses. Those businesses are currently attributed to two

13

tracking stock groups: the QVC Group and the Liberty Ventures Group. The businesses and assets attributed to the QVC Group (Nasdaq: QVCA, QVCB) consist of Liberty Interactive’s subsidiary, QVC, Inc., and its interest in HSN, Inc., and the businesses and assets attributed to the Liberty Ventures Group (Nasdaq: LVNTA, LVNTB) consist of all of Liberty Interactive Corporation’s businesses and assets other than those attributed to the QVC Group, including its interest in Expedia, Interval Leisure Group and FTD, its subsidiaries Bodybuilding.com, CommerceHub, LMC Right Start and Evite, and minority interests in Time Warner, Time Warner Cable and Lending Tree.

42. Defendant Ziggy Merger Sub, LLC is a Delaware limited liability company and a direct, wholly owned subsidiary of Liberty, and was created for purposes of effectuating the Proposed Transaction.

43. Defendant Mocha Merger Sub, Inc. is a Delaware corporation and a direct, wholly owned subsidiary of Ziggy Merger Sub, LLC, and was created for purposes of effectuating the Proposed Transaction.

44. Non-party QVC, Inc. is a wholly owned subsidiary of Liberty Interactive Corporation, and is the world’s leading video and ecommerce retailer. QVC sells its customers thousands of the most innovative and contemporary beauty, fashion, jewelry and home products. Its programming is distributed to approximately 340 million homes worldwide through operations in the U.S., Japan, Germany, United Kingdom, Italy, France and a joint venture in China. Based in West Chester, Pennsylvania and founded in 1986, QVC has evolved from a TV shopping company to a leading ecommerce and mobile commerce retailer.

45. The defendants referenced in the preceding paragraphs are collectively referred to

14

as the “Defendants”.

CLASS ACTION ALLEGATIONS

46. Plaintiff brings this action pursuant to Rule 23 of the Federal Rules of Civil Procedure, individually and on behalf of the other public stockholders of zulily who are being and will be harmed by Defendants’ actions described herein (the “Class”). The Class specifically excludes Defendants herein, and any person, firm, trust, corporation or other entity related to, or affiliated with, any of the Defendants.

47. This action is properly maintainable as a class action.

48. The Class is so numerous that joinder of all members is impracticable. As of August 2, 2015, there were approximately 67.65 million shares of zulily common stock outstanding, owned by numerous stockholders dispersed throughout the United States.

49. Questions of law and fact exist that are common to the Class, including, among others:

(a) whether the Defendants have violated Sections 14(d)(4) , 14(e) and 20(a) of the Exchange Act in connection with the Proposed Transaction; and

(b) whether Plaintiff and the other members of the Class would be irreparably harmed if the Proposed Transaction complained of herein is consummated as currently contemplated.

50. Plaintiff is committed to prosecuting this action and has retained competent counsel experienced in litigation of this nature. Plaintiff’s claims are typical of the claims of the other members of the Class and Plaintiff has the same interests as the other members of the Class.

15

Accordingly, Plaintiff is an adequate representative of the Class and will fairly and adequately protect the interests of the Class.

51. The prosecution of separate actions by individual members of the Class would create the risk of inconsistent or varying adjudications with respect to individual members of the Class, which would establish incompatible standards of conduct for Defendants, or adjudications with respect to individual members of the Class which would, as a practical matter, be dispositive of the interests of the other members not parties to the adjudications or substantially impair or impede their ability to protect their interests.

52. Preliminary and final injunctive relief on behalf of the Class as a whole is entirely appropriate because Defendants have acted, or refused to act, on grounds generally applicable and causing injury to the Class.

SUBSTANTIVE ALLEGATIONS

A. Summary of the Proposed Transaction

53. On August 17, 2015, zulily and Liberty issued a press release announcing the Proposed Transaction, which states in relevant part:

Englewood, CO, and Seattle, WA, August 17, 2015 — Liberty Interactive Corporation (“Liberty Interactive”) (Nasdaq: QVCA, QVCB, LVNTA, LVNTB) and zulily, inc. (“zulily”) (Nasdaq: ZU) today announced that they have entered into a definitive agreement (the “Agreement”) under which Liberty Interactive will acquire all outstanding shares of zulily for $18.75 per share. The acquisition will be attributed to Liberty Interactive’s QVC Group tracking stock.

“We are excited for zulily to join the Liberty family,” stated Greg Maffei, Liberty Interactive President and CEO. “Darrell, Mark and their team have built an impressive business around entertainment, discovery and value to the customer, which fits perfectly with the QVC philosophy. Combined under Liberty, we have an incredible opportunity to delight shoppers from the TV to the Internet.”

16

“As the world leader in video and eCommerce retail, QVC is dedicated to reimagining shopping, entertainment and community as one,” said Mike George, QVC President and CEO. “In zulily, we see a like-minded brand that shares our passion for discovering great products, for delivering honest value, and for building long term relationships with customers. Our teams are committed to learning from and inspiring each other and leveraging our platforms in new ways to accelerate growth, serve our customers better, and realize the full potential of both of these extraordinary brands.”

“Mark Vadon and I are incredibly excited to announce our partnership with QVC. QVC has built an amazing business with a great culture and incredibly similar understanding for bringing entertainment, discovery and value into the daily customer experience.” said Darrell Cavens, President and CEO of zulily. “This combination under Liberty is about investing in our future and providing a tremendous opportunity to accelerate our platform for growth of the zulily brand through the partnership with QVC.”

The proposed transaction will bring two highly complementary businesses under common ownership and further strengthen QVC’s leadership position in experiential, discovery driven shopping. While QVC and zulily will be operated as separate consumer facing brands, the collaboration creates numerous exciting opportunities, including leveraging QVC’s global scale, curation, vendor relationships and video commerce expertise at zulily. Similarly, zulily’s younger customer demographic, personalization expertise and eCommerce capabilities will boost QVC.

Following the close of the transaction, zulily will remain based in Seattle. zulily will continue to be run by its talented management team, with Darrell Cavens remaining President and CEO of zulily. In connection with the transaction, Mike George is being appointed to the Executive Committee of the Liberty Interactive Board of Directors and will serve on that committee with John Malone and Greg Maffei. Darrell Cavens will report directly to Mike George and the other members of the Executive Committee. In addition, zulily co-founder Mark Vadon will join the Liberty Interactive Board of Directors.

The deal values zulily at $2.4 billion. Liberty Interactive has agreed to provide $9.375 in cash and 0.3098 newly issued shares of QVCA for each zulily share. Funding for the cash portion of the consideration is expected to come from cash on hand at zulily and QVC’s revolving credit facility.

The transaction has been approved by the boards of directors of both companies and is anticipated to close during the fourth quarter of 2015. Pursuant to the Agreement, a subsidiary of Liberty Interactive will commence an exchange offer for 100% of the outstanding shares of zulily common stock for $18.75 per share. The tender offer is required to be commenced within 15 business days of

17

today and to remain open for at least 20 business days after launch. Concurrent with the execution of the Agreement, zulily’s founding shareholders, representing approximately 45% of zulily’s outstanding shares, have signed a Tender and Support Agreement, pursuant to which they have agreed to tender all of their shares into the exchange offer, subject to certain exceptions. Following successful completion of the exchange offer, any shares not acquired in the exchange offer will be acquired in a second-step merger at the same $18.75 per share deal price. Closing of the exchange offer is conditioned upon customary closing conditions, including the expiration or termination of the applicable waiting period under the Hart-Scott-Rodino Antitrust Improvements Act and there being validly tendered and not withdrawn a number of shares of zulily common stock equal to at least a majority of the total outstanding voting power. The offer is not subject to any financing condition.

Baker Botts L.L.P. is acting as legal advisor for Liberty Interactive. Goldman Sachs is serving as financial advisor for zulily and Weil, Gotshal & Manges LLP and Cooley LLP are acting as legal advisors.

B. The Proposed Transaction Undervalues zulily Shares

54. Since its inception in 2010, zulily has emerged as a destination brand for millions of millennial customers, becoming the third fastest retailer in history (along with Amazon and Old Navy) to reach $1 billion in annual net sales. Most of zulily’s business is in the U.S., but it also serves customers in Canada, Australia, the U.K., Ireland, Mexico, Hong Kong, Singapore, and many other countries. Zulily is headquartered in Seattle and operates three state of the art fulfillment centers in Nevada, Ohio, and Pennsylvania. The Company focuses on bringing customers special finds every day, introducing thousands of new items daily, including clothing, shoes, home décor, toys, gifts and more, through its web and mobile platforms. Unique products from up-and-coming brands are featured alongside favorites from top brands. Zulily’s platforms are powered by a unique personalization model that creates a customized and relevant experience for each shopper. Its shares are traded on the NASDAQ under the symbol ZU.

18

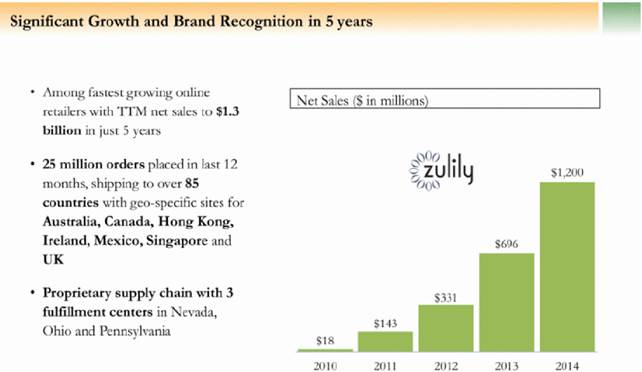

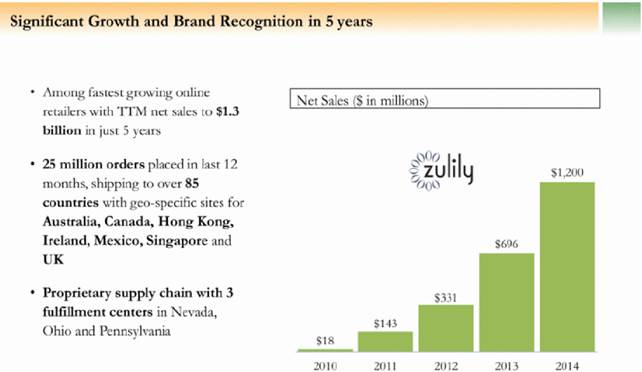

55. Zulily experienced a period of exponential growth from its founding in 2010 through 2014. The Company generated sales of $18 million in 2010, which jumped to $143 million a year later and $1.2 billion by 2014.

56. Zulily’s unprecedented success out of the gate caused its stock price to soar shortly after its $22 IPO in November 2013.

57. On February 24, 2014, the Company announced the following impressive financial and operating results for the full fiscal year 2013: net sales increased to $695.7 million, up 110% year over year; adjusted EBITDA increased to $27.0 million, compared to a loss of $5.9 million in the prior year; net income increased to $12.9 million compared to a net loss of $10.3 million in the prior year; active customers grew to 3.2 million by the end of 2013, an increase of over 100% year over year; non-GAAP adjusted EBITDA for the fourth quarter 2013 was $17.8 million compared to $4.7 million for the fourth quarter of 2012, which represented a 277% year over year increase; and Non-GAAP free cash flow totaled $37.0 million for the fourth quarter 2013 compared to $13.0 million for the fourth quarter of 2012, which represented a 184% year over year increase.

58. As a result of the strong financial results, the Company’s stock price peaked at $72.75 per share on February 27, 2014.

59. The problem for the Company was that its initial growth, which caused Wall Street analysts to set unrealistic expectations for the Company’s future financial performance, was unsustainable. Indeed, it would be unrealistic to expect a company to show 30%-plus revenue growth every quarter.

19

60. Thus, while zulily has continued to enjoy strong financial results over the past several quarters, its results have nonetheless missed Wall Street’s expectations, causing the Company’s stock price to drop.

61. On May 6, 2014, zulily announced its financial results for the first quarter of 2014. Net sales increased to $237.9 million, up 87% year over year; Non-GAAP adjusted EBITDA for the first quarter 2014 increased to $2.6 million, up 481% year over year; Non-GAAP free cash flow for the first quarter 2014 increased to $1.6 million, up 172% year over year; active customers grew to 3.7 million by the end of first quarter 2014, an increase of 93% year over year; total orders placed increased to 5.5 million for the first quarter 2014, an increase of 91% year over year; and average order value increased to $55.34 for the first quarter 2014, an increase of 4% year over year. Despite the strong results, the Company missed analysts’ estimates, causing its stock price to fall from $48.45 to $32.28.

62. On August 6, 2014, zulily announced its financial results for the second quarter of 2014. Net sales increased to $285.0 million, up 97% year over year; Non-GAAP adjusted EBITDA for the second quarter of 2014 increased to $14.4 million, up 106% year over year; active customers grew to 4.1 million by the end of second quarter 2014, an increase of 86% year over year; and total orders placed increased to 5.4 million for the Second Quarter 2014, an increase of 92% year over year. The Company’s stock price closed at $39.37 after the results were announced.

63. On November 4, 2014, zulily announced its financial results for the third quarter of 2014. Net sales increased to $285.8 million, up 72% year over year; Non-GAAP adjusted EBITDA for the third quarter 2014 increased to $6.4 million, up 257% year over year; active

20

customers grew to 4.5 million by the end of third quarter 2014, an increase of 72% year over year; and total orders placed increased to 5.9 million for the third quarter 2014, an increase of 63% year over year.

64. Despite an impressive earnings report, zulily’s forecast for its fourth quarter came out below what analysts had predicted. It was speculated that zulily’s low fourth quarter outlook was determined as a result of the Company wanting to maintain its reputation as a provider of premium-branded products during the holidays, a time when retailers typically host big sales to attract a higher volume of customers looking to buy gifts. Consequently, despite beating analysts’ expectations for the quarter, zulily’s share price dropped about 20% and closed at $28.61 on November 5, 2014.

65. On February 11, 2015, zulily announced its fourth quarter and full fiscal year 2014 results. Fourth quarter and full year 2014 net sales increased to $391.3 million and $1.2 billion, up 52% and 72% year over year, respectively; fourth quarter and full year 2014 non-GAAP adjusted EBITDA increased to $20.3 million and $43.7 million, compared to $17.8 million and $27.0 million, respectively, in the prior year; fourth quarter and full year 2014 net income was $10.9 million and $14.9 million, compared to $12.8 million and $12.9 million, respectively, in the prior year; active customers grew to 4.9 million by the end of fourth quarter 2014, an increase of 54% year over year; and total orders placed increased to 6.8 million for the fourth quarter 2014, an increase of 42% year over year. Despite the improving results, the Company missed analysts’ earnings expectations and its stock price dropped to $14.52.

66. On May 5, 2015, zulily announced its financial results for the first quarter of 2015. Net sales increased to $306.6 million, up 29% year over year; 2015 gross profit increased to $92.2

21

million, up 45% year over year; Non-GAAP adjusted EBITDA for the first quarter 2015 increased to $4.4 million, up 66% year over year; active customers grew to 5.0 million by the end of first quarter 2015, an increase of 35% year over year; and total orders placed increased to 6.3 million for the first quarter 2015, an increase of 15% year over year.

67. Most recently, on August 5, 2015, zulily announced its financial results for the second quarter of 2015. Net sales increased to $297.6 million, up 4% year over year; gross profit increased to $92.5 million, up 14% year over year; active customers grew to 4.9 million by the end of second quarter 2015, an increase of 19% year over year; and total orders placed increased to 5.8 million for the second quarter 2015, an increase of 7% year over year.

68. Zulily’s financial performance during the four years since its inception are summarized in the following table that was contained in the Company’s most recent 10-K filing with the SEC:

|

|

|

Fiscal years |

|

|

|

|

2014 |

|

2013 |

|

2012 |

|

2011 |

|

2010 |

|

|

|

|

(in thousands, except revenue per active customer and average order value) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA |

|

$ |

43,727 |

|

$ |

27,046 |

|

$ |

(5,920 |

) |

$ |

(8,871 |

) |

$ |

(3,734 |

) |

|

Free cash flow |

|

$ |

62,257 |

|

$ |

53,514 |

|

$ |

8,425 |

|

$ |

3,749 |

|

$ |

(1,164 |

) |

|

Active customers |

|

4,887 |

|

3,172 |

|

1,580 |

|

810 |

|

157 |

|

|

Revenue per active customer |

|

$ |

246 |

|

$ |

219 |

|

$ |

210 |

|

$ |

176 |

|

$ |

117 |

|

|

Total orders placed |

|

23,624 |

|

14,144 |

|

6,950 |

|

2,998 |

|

384 |

|

|

Average order value |

|

$ |

56.07 |

|

$ |

54.75 |

|

$ |

53.37 |

|

$ |

53.48 |

|

$ |

52.52 |

|

|

Non-GAAP diluted net income (loss) per share |

|

$ |

0.22 |

|

$ |

0.17 |

|

$ |

(0.08 |

) |

$ |

(0.07 |

) |

$ |

(0.05 |

) |

69. In sum, zulily remains a strong e-commerce brand with nearly 5 million active customers and $246 in revenue per active customer as of 2014. And while Wall Street analysts’ unrealistic expectations concerning the Company’s ability to sustain the unprecedented growth it experienced after its IPO has caused its stock price to suffer, zulily remains a promising company

22

with a strong brand, high customer loyalty, approximately $300 million in cash, no debt and a favorable price to sale ratio.

70. Indeed, in an investor presentation announcing the Proposed Transaction, Liberty noted that “zulily has attractive profitability, unit economics and business model” and that it “brings exposure to [the] highly attractive ‘Millennial Mom’ demographic.”

71. In the same presentation, Liberty went on to tout the “significant growth and brand recognition” Zulily has achieved since its founding:

72. Accordingly, the Transaction Consideration zulily’s public stockholders stand to receive is insufficient, as it fails to account for the Company’s future earnings potential and fails to adequately compensate the Class when factoring in the significant benefits Liberty stands to reap if the Proposed Transaction is completed.

23

73. In sum, zulily is well-positioned to generate significant earnings in the foreseeable future. Despite zulily’s bright financial prospects, the Board has now agreed to sell the Company at a time when its stock price does not accurately reflect the Company’s intrinsic value and growth prospects, to the detriment of zulily’s common stockholders.

C. The Preclusive Deal Protection Provisions Deter Superior Offers

74. In addition to failing to obtain adequate consideration for zulily’s stockholders, the Individual Defendants agreed to certain deal protection devices that operate conjunctively to lockup the Proposed Transaction and ensure that no competing offers will emerge for the Company.

75. First, the Reorganization Agreement provides for an onerous no solicitation provision that prohibits the Company or the Individual Defendants from taking any affirmative action to obtain the best price possible under the circumstances. Specifically, section 5.3 of the Reorganization Agreement states that the Company and the Individual Defendants shall not:

(i) solicit, initiate, knowingly encourage or knowingly facilitate the making, submission or announcement of any inquiries or the making of any proposal or offer constituting or that would reasonably be expected to lead to an Acquisition Proposal;

(ii) furnish any non-public information regarding any of the Company or any Company Subsidiary to any Person (other than Parent, its Affiliates and Parent’s or Purchaser’s Representatives acting in their capacity as such) in connection with or in response to an Acquisition Proposal or any proposal, inquiry or offer that would reasonably be expected to lead to an Acquisition Proposal

(iii) engage in discussions or negotiations with any Person with respect to any Acquisition Proposal or any proposal, inquiry or offer that would reasonably be expected to lead to an Acquisition Proposal (other than to state that they currently are not permitted to have discussions);

(iv) approve, endorse or recommend any Acquisition Proposal or any proposal, inquiry or offer that would reasonably be expected to lead to an Acquisition Proposal;

24

(v) make or authorize any public statement, recommendation or solicitation in support of any Acquisition Proposal or any proposal, inquiry or offer that would reasonably be expected to lead to an Acquisition Proposal;

(vi) enter into any letter of intent or agreement in principle or any Contract with respect to any Acquisition Proposal or any proposal, inquiry or offer that would reasonably be expected to lead to an Acquisition Proposal (other than an Acceptable Confidentiality Agreement in accordance with Section 5.3(c)); or

(vii) reimburse or agree to reimburse the expenses of any other Person (other than the Company’s Representatives) in connection with an Acquisition Proposal or any inquiry, discussion, offer or request that would reasonably be expected to lead to an Acquisition Proposal.

76. Additionally, Section 5.3 of the Reorganization Agreement grants Liberty recurring and unlimited matching rights, which provides it with: (i) unfettered access to confidential, non-public information about competing proposals from third parties which it can use to prepare a matching bid; and (ii) four business days to negotiate with zulily, amend the terms of the Reorganization Agreement and make a counter-offer in the event a superior offer is received.

77. Furthermore, the Tender and Support Agreement Individual Defendants Cavens and Vadon entered into virtually lock-up the Proposed Transaction and undoubtedly deter superior offers for the Company. Indeed, pursuant to the Agreements, Cavens and Vadon must tender all of their shares, which represent approximately 90% of the voting power of the Company’s common stock, in the Tender Offer. And even in the event the Board receives a superior proposal and is allowed to make an Adverse Recommendation Change, Cavens and Vadon must still tender shares representing 34.99% of the outstanding voting power of the Company in the Tender Offer.

78. Thus, by virtue of the Tender and Support Agreements, even if a superior proposal were to emerge, only 15.1% of the Company’s voting power of the Company’s common stock needs to be tendered in order for the Proposed Transaction to be consummated. And given that Andreessen Horowitz holds share representing 11.8% of the Company’s voting power and, as

25

explained above, has undoubtedly pledged to support the Proposed Transaction even though it has not entered into a formal support agreement, in all likelihood less than 4% of the Company’s voting shares would need to be tendered during the Tender Offer in order for the Proposed Transaction to be completed even in the event a superior proposal is received.

79. The non-solicitation and matching rights provisions, when coupled with the Tender and Support Agreement, ensure that a superior bidder will not emerge, as any potential suitor will undoubtedly be deterred from expending the time, cost, and effort of making a superior proposal while knowing that Liberty can easily foreclose a competing bid, and that a significant percentage of the Company’s shares must be tendered via the Tender Offer regardless of whether a better offer has been made. As a result, these provisions unreasonably favor Liberty, to the detriment of zulily’s public stockholders.

80. Lastly, section 7.3 of the Reorganization Agreement provides that zulily must pay Liberty a termination fee of $79 million in the event the Company elects to terminate the Reorganization Agreement to pursue a superior proposal. Further, in the event a superior proposal is made directly the zulily’s stockholders or publicly communicated to the Company, Liberty elects to terminate the Reorganization Agreement as a result, and the Company then enters into a definitive agreement with respect to the superior proposal within twelve months, the Company must still pay Liberty the Termination Fee. Accordingly, the termination fee provision further ensures that no competing offer will appear, as any competing bidder would have to pay a naked premium for the right to provide zulily’s stockholders with a superior offer.

26

81. Ultimately, these deal protection provisions unreasonably restrain zulily’s ability to solicit or engage in negotiations with any third party regarding a proposal to acquire all or a significant interest in the Company.

D. The Recommendation Statement Provides Stockholders With Materially Incomplete and Misleading Information Concerning The Proposed Transaction

82. On September 1, 2015, Defendants caused the materially incomplete and misleading Recommendation Statement to be filed with the SEC. While the Recommendation Statement provides a summary of the strategic review process the Board undertook prior to voting to enter into the Reorganization Agreement with Liberty, and the financial analyses Goldman Sachs performed in support of its fairness opinion, it omits certain pieces of critical information which render portions of the Recommendation Statement materially incomplete and misleading.

83. The Recommendation Statement also fails to provide a fair summary of the key inputs utilized in the financial analyses Goldman Sach’s performed in support of its fairness opinion. Information underlying or supporting the purported “fair value” of the Transaction Consideration is material to stockholders and must be disclosed. Stockholders are entitled to the information necessary to make an informed decision concerning the adequacy of the consideration they are being offered via the Tender Offer, including the underlying data Goldman Sachs relied upon, the key assumptions that Goldman Sachs made in performing its valuation analyses, and the range of values that resulted from those analyses. Here, Goldman Sachs’ analyses incorporated certain critical assumptions that significantly affected the output (valuation) of those analyses. Without this material information, stockholders have no basis on which to judge the adequacy of Liberty’s offer. The following information was not adequately disclosed and is material to stockholders.

27

84. The Recommendation Statement states that in connection with rendering its fairness opinion, Goldman Sachs reviewed and utilized certain internal financial analyses and forecasts for the Company prepared by its management, and for Liberty prepared by its management, which are referred to as the “Management Forecasts.” Recommendation Statement at 28. However, the Recommendation Statement fails to specify whether the forecasts for the Company that Goldman Sachs utilized for the various financial analyses it performed were the “Initial Forecasts” that were prepared by management in May 2015, or the “Revised Forecasts” that were prepared by management in July 2015, which included adjustments to reflect a lower growth rate and EBITDA margin than assumed in the Initial Forecasts. Zulily’s stockholders are entitled to know which Forecasts Goldman Sachs utilized in connection with preparing its fairness opinion, and such information is clearly material.

85. With respect to the Background of the Offer section, the Recommendation Statement fails to disclose whether the Board or Transaction Committee considered retaining any other financial advisors prior to the time it engaged Goldman Sachs. This information is material to stockholders given the significant relationship Goldman Sachs has with Liberty and its related entities. Zulily stockholders would find it material to know whether the Board actively sought to engage an impartial financial advisor, or whether Goldman Sachs was merely retained to provide an aura of legitimacy to the sale process despite its inability to impartially evaluate the fairness of the Transaction Consideration to zulily’s stockholders.

86. The Recommendation Statement also fails to provide any meaningful information concerning “the manner in which the Initial Forecasts were prepared and the material assumptions underlying the Initial Forecasts” (Recommendation Statement at 16), which is material to zulily

28

stockholders given that a mere two months later Company management and the Board determined that the Initial Forecasts were overly aggressive and needed to be revised downward.

87. The Recommendation Statement further fails to provide a fair summary of the “risks and uncertainties” and “factors and risks in the Company’s business” that Company management and the Board cited as the basis for needing to revise the Initial Forecasts downward (Recommendation Statement at 18, 37).

88. The Recommendation Statement further fails to provide a fair summary of the “sensitivity analysis” that was performed with respect to the Initial Forecasts and provided to the Board during its July 8, 2015 meeting, which purportedly warranted adjusting the Initial Forecasts downward (see Recommendation Statement at 18, 37). Without a fair understanding of what the “sensitivity analysis” included, zulily’s stockholders have no way of determining whether the downward adjustment to the Initial Forecasts was actually warranted, or simply served as a pretext to enable Goldman Sachs to provide valuation analyses that make the Transaction Consideration appear more favorable to zulily’s stockholders.

89. The Recommendation Statement also fails to provide a fair summary of the “key differences” between the Initial Forecasts and the downward adjusted Revised Forecasts, which were discussed with the Board during its July 28, 2015 meeting (Recommendation Statement at 20). Those “differences” are material for zulily’s stockholders to understand the specific changes in the Company’s business operations that purportedly caused Company management and the Board to adjust their forecasts downward.

90. The Recommendation Statements fails to provide any explanation concerning why the Transaction Committee only authorized Company management to present the Initial Forecasts

29

projections for fiscal years 2015-2017 to Liberty, despite the fact that management had prepared projections through 2020 (Recommendation Statement at 16). The information is material to zulily stockholders, because the projections for 2018-2020 showed significant increases in key financial metrics and thus supported a higher valuation for the Company. Accordingly, zulily’s stockholders would find it material to understand the Transaction Committee’s rationale for only providing the forecast for the earlier years to Liberty.

91. With respect to Goldman Sachs’ Illustrative Pro Forma Combined Company Discounted Cash Flow Analysis (Recommendation Statement at 30-31), the Recommendation Statement fails to disclose the following key inputs, which are necessary for zulily’s stockholders to have a fair understanding of the work performed by Goldman Sachs and are therefore material:

a. The estimates of unlevered free cash flows of the combined company, which were used to derive an illustrative range of implied present values of the implied value of the consideration to be paid to zulily’s stockholders;

b. The pro forma estimates of the weighted average cost of capital of the combined company following the completion of the Proposed Transaction, which was used to calculate a purportedly appropriate discount rate;

c. The estimate of net debt of the combined company;

d. The value of Liberty Interactive’s equity investment in HSN, Inc. attributed to the QVC Group; and

e. The estimated equity value of Series B QVC Group Common Stock of the combined company.

92. With respect to Goldman Sachs’ Selected Companies Analysis (Recommendation Statement at 31-33), the Recommendation Statement fails to disclose the following key inputs and range of values, which are necessary for zulily’s stockholders to have a fair understanding of the work performed by Goldman Sachs and are therefore material:

30

a. The low, high and mean for each of the multiples and ratios that were calculated; and

b. The specific criteria utilized for purposes of selecting the companies that were selected, which is material to stockholders because it enables them to consider and determine whether the companies selected were appropriate and actually comparable.

93. With respect to Goldman Sachs’ Illustrative Present Value of Future Share Price Analysis (Recommendation Statement at 33) the Recommendation Statement fails to disclose the following key inputs and range of values, which are necessary for zulily’s stockholders to have a fair understanding of the work performed by Goldman Sachs and are therefore material:

a. The “certain financial information from the Management Forecasts” that Goldman Sachs utilized in connection this analysis; and

b. The end of year net debt balance from the Management Forecasts.

94. With respect to Goldman Sachs’ Selected Precedent Transactions Analysis (Recommendation Statement at 34), the Recommendation Statement fails to disclose the following key inputs and range of values, which are necessary for zulily’s stockholders to have a fair understanding of the work performed by Goldman Sachs and are therefore material:

a. The implied premium Gold Sachs calculated for each of the transactions, which is material to stockholders because without it they are unable to determine whether the applied illustrative premia range was reasonable, particularly in light of the fact that certain transactions from 2008-2011 do not accurately reflect current economic conditions; and

b. The NTM multiple calculated for each of the selected transactions, which is material to stockholders because without it they are unable to determine whether the applied Adjusted EBITDA multiples range was reasonable.

95. With respect to the “Certain Forecasts” section (Recommendation Statement at 36-38), the Recommendation Statement fails to disclose the unlevered free cash flow projections for the QVC Forecasts. Those projections are material to zulily’s stockholders, as a portion of the

31

consideration they are being offered is in the form of QVCA stock, and the value of that stock is heavily dependent upon QVC’s anticipated future cash flows.

96. The Recommendation Statement also fails to disclose any of the pro forma forecasts for the combined company, which were utilized by Goldman Sachs’ in connection with its financial analyses (see Recommendation Statement at 30). Such pro forma forecasts are clearly material to zulily’s stockholders, as they provide detailed information concerning the projected financial performance of the combined company in which zulily’s stockholders are being offered an ownership stake.

97. With respect to the section of the Recommendation Statement discussing Goldman Sach’s prior work and relationships with zulily, Liberty, and their respective affiliates (Recommendation Statement at 35-36), the Recommendation statement fails to disclose:

a. The identity of the “significant stockholder of Liberty Interactive” in which Goldman Sachs has an economic interest, and/or a fair description of Goldman’s interest including its economic value;

b. The amount of compensation Goldman Sachs has received for the “certain financial advisory and/or underwriting services” it has provided to the Company during the past two years; and

c. The amount of compensation Goldman Sachs has received in connection with the financial advisory and/or underwriting services it has provided to Liberty-related entities during the past two years.

98. This information is material to zulily’s stockholders because without it they are unable to fairly assess whether Goldman Sachs’ prior work for Liberty and zulily improperly influenced its financial analyses and fairness opinion. Indeed, such material information concerning the relationship between interested parties would clearly assume significance in the deliberations of a reasonable zulily stockholder, and disclosure of such information will give notice to stockholders to examine the proposed transaction more critically.

32

99. With respect to the transaction fee Goldman Sachs will be paid in connection with the Proposed Transaction, the Recommendation Statement fails to state whether the “total consideration paid in the Transaction” will be calculated based upon the closing price of QVCA Stock as of August 14, 2015, or the date on which the Proposed Transaction is consummated (Recommendation Statement at 36). This information is material, as QVCA’s stock price has declined significantly since the announcement of the Proposed Transaction, and therefore zulily’s stockholders are currently unable to determine whether the estimated fee of $26 million Goldman Sachs stands to receive will change based upon changes in QVCA’s stock price.

100. Defendants knowingly or recklessly failed to disclose the material information discussed above. Without materially complete disclosure of the information set forth above, stockholders cannot make an informed decision concerning whether or not to tender their shares. Accordingly, Plaintiff seeks injunctive and other equitable relief to prevent the irreparable injury that Company stockholders will continue to suffer absent judicial intervention.

E. Defendants Knew or Recklessly Disregarded that the Recommendation Statement Omits Material Information

101. The Individual Defendants, and thus zulily, knew or disregarded that the Recommendation Statement contains the materially incomplete and misleading information discussed above.

102. Specifically, Defendants undoubtedly reviewed the contents of the Recommendation Statement before it was filed with the SEC. Indeed, Individual Defendant Cavens has attested that he made due inquiry concerning the information set forth in the Recommendation Statement and that it is true, complete and correct to the best of his knowledge (Recommendation Statement at 49). Defendants were thus aware that the Recommendation

33

Statement contains the misleading partial disclosures and/or omits the material information referenced above.

103. Further, the Recommendation Statement indicates that on August 16, 2015, the date on which the Board voted to approve the Proposed Transaction:

Representatives of Goldman Sachs then reviewed with the Board the process undertaken by the Transaction Committee, updated the Board on the various discussions that the Company engaged in with third parties regarding potential strategic opportunities and presented its financial analysis of the Offer Price to be received by the Company’s stockholders and discussed the methodologies used in such analysis. At the request of the Transaction Committee, representatives of Goldman Sachs orally delivered to the Transaction Committee Goldman Sachs’ opinion that as of such date, based upon and subject to certain assumptions, qualifications, limitations and other matters, the consideration to be paid to the holders (other than the Liberty-related entities and their respective affiliates) of Shares, taken in the aggregate, pursuant to the Reorganization Agreement was fair from a financial point of view to such holders. The Transaction Committee then convened and provided additional background to the Board on the process undertaken by the Transaction Committee and unanimously determined that the Reorganization Agreement and the transactions contemplated by the Reorganization Agreement (including the related transaction agreements) were advisable, fair to, and in the best interests of, the Company and its stockholders.

104. The Recommendation Statement also indicates that on August 16, 2015 Goldman Sachs provided the Board with an analysis of the Proposed Transaction and presented its oral opinion that based upon and subject to the factors and assumptions set forth therein and reviewed at the meeting, the Transaction Consideration is fair from a financial point of view to zulily’s stockholders.

105. The Recommendation Statement further indicates that both the Transaction Committee and the Board considered the various financial analyses presented by Goldman Sachs in connection with approving the Reorganization Agreement and making their respective recommendations that zulily stockholders tender their shares in the Tender Offer (Registration Statement at 24, 26).

34

106. Accordingly, the Individual Defendants undoubtedly reviewed or were presented with the material information concerning Goldman Sachs’ financial analyses and the Company’s forecasts which has been omitted from the Recommendation Statement, and thus knew or recklessly disregarded that such information has been omitted.

FIRST CAUSE OF ACTION

Claim for Violations of Section 14(e) of the Exchange Act Against

All Defendants

107. Plaintiff repeats and realleges each allegation contained above as if fully set forth herein.

108. Section 14(e) of the Exchange Act provides that it is unlawful “for any person to make any untrue statement of a material fact or omit to state any material fact necessary in order to make the statements made, in the light of the circumstances under which they are made, not misleading...” 15 U.S.C. §78n(e).

109. As discussed above, zulily filed and delivered the Recommendation Statement to its stockholders, which Defendants knew or recklessly disregarded contained material omissions and misstatements as set forth above.

110. During the relevant time period, Defendants disseminated the false and misleading Recommendation Statement above. Defendants knew or recklessly disregarded that the Recommendation Statement failed to disclose material facts necessary in order to make the statements made, in light of the circumstances under which they were made, not misleading.

111. The Recommendation Statement was prepared, reviewed and/or disseminated by Defendants. It misrepresented and/or omitted material facts, including material information about

35

the consideration offered to stockholders via the Tender Offer, the intrinsic value of the Company, and potential conflicts of interest faced by the Company’s financial advisor.

112. In so doing, Defendants made untrue statements of material facts and omitted material facts necessary to make the statements that were made not misleading in violation of Section 14(e) of the Exchange Act. By virtue of their positions within the Company and/or roles in the process and in the preparation of the Recommendation Statement, Defendants were aware of this information and their obligation to disclose this information in the Recommendation Statement.

113. The omissions and incomplete and misleading statements in the Recommendation Statement are material in that a reasonable stockholder would consider them important in deciding whether to tender their shares. In addition, a reasonable investor would view the information identified above which has been omitted from the Recommendation Statement as altering the “total mix” of information made available to stockholders.

114. Defendants knowingly or with deliberate recklessness omitted the material information identified above from the Recommendation Statement, causing certain statements therein to be materially incomplete and therefore misleading. Indeed, while Defendants undoubtedly had access to and/or reviewed the omitted material information in connection with approving the Proposed Transaction, they allowed it to be omitted from the Recommendation Statement, rendering certain portions of the Recommendation Statement materially incomplete and therefore misleading.

115. The misrepresentations and omissions in the Recommendation Statement are material to Plaintiff and the Class, and Plaintiff and the Class will be deprived of their entitlement

36

to make a fully informed decision if such misrepresentations and omissions are not corrected prior to the expiration of the Tender Offer.

SECOND CAUSE OF ACTION

Claim for Violations of Section 14(d)(4) of the Exchange Act and SEC Rule 14d-9 (17 C.F.R. § 240.14d-9) Against All Defendants

116. Plaintiff repeats and realleges each allegation contained above as if fully set forth herein.

117. Defendants have caused the Recommendation Statement to be issued with the intention of soliciting stockholder support of the Proposed Transaction.

118. Section 14(d)(4) of the Exchange Act and SEC Rule 14d-9 promulgated thereunder require full and complete disclosure in connection with tender offers. Specifically, Section 14(d)(4) provides that:

Any solicitation or recommendation to the holders of such a security to accept or reject a tender offer or request or invitation for tenders shall be made in accordance with such rules and regulations as the Commission may prescribe as necessary or appropriate in the public interest or for the protection of investors.

119. SEC Rule 14d-9(d), which was adopted to implement Section 14(d)(4) of the Exchange Act, provides that:

Information required in solicitation or recommendation. Any solicitation or recommendation to holders of a class of securities referred to in section 14(d)(1) of the Act with respect to a tender offer for such securities shall include the name of the person making such solicitation or recommendation and the information required by Items 1 through 8 of Schedule 14D-9 (§ 240.14d-101) or a fair and adequate summary thereof.

120. In accordance with Rule 14d-9, Item 8 of a Schedule 14D-9 requires a Company’s directors to:

Furnish such additional information, if any, as may be necessary to make the required statements, in light of the circumstances under which they are made, not materially misleading.

37

121. The Recommendation Statement violates Section 14(d)(4) and Rule 14d-9 because it omits material information, as set forth above. Moreover, in the exercise of reasonable care, Defendants should have known that the Recommendation Statement is materially misleading and omits material facts that are necessary to render them non-misleading.

122. Defendants knowingly or with deliberate recklessness omitted the material information identified above from the Recommendation Statement, causing certain statements therein to be materially incomplete and therefore misleading. Indeed, while Defendants undoubtedly had access to and/or reviewed the omitted material information in connection with approving the Proposed Transaction, they allowed it to be omitted from the Recommendation Statement, rendering certain portions of the Recommendation Statement materially incomplete and therefore misleading.

123. The misrepresentations and omissions in the Recommendation Statement are material to Plaintiff and the Class, and Plaintiff and the Class will be deprived of their entitlement to make a fully informed decision if such misrepresentations and omissions are not corrected prior to the expiration of the Tender Offer.

THIRD CAUSE OF ACTION

Claim for Violations of Section 20(a) of the Exchange Act

Against the Individual Defendants

124. Plaintiff repeats and realleges each allegation contained above as if fully set forth herein.

125. The Individual Defendants acted as controlling persons of zulliy within the meaning of Section 20(a) of the Exchange Act as alleged herein. By virtue of their positions as officers and/or directors of zulily, and participation in and/or awareness of the Company’s operations

38

and/or intimate knowledge of the false statements contained in the Recommendation Statement filed with the SEC, they had the power to influence and control and did influence and control, directly or indirectly, the decision making of the Company, including the content and dissemination of the various statements which Plaintiff contends are false and misleading.

126. Each of the Individual Defendants were provided with or had unlimited access to copies of the Recommendation Statement and other statements alleged by Plaintiff to be misleading prior to and/or shortly after these statements were issued and had the ability to prevent the issuance of the statements or cause the statements to be corrected.

127. In particular, each of the Individual Defendants had direct and supervisory involvement in the day-to-day operations of the Company, and, therefore, is presumed to have had the power to control or influence the particular transactions giving rise to the securities violations alleged herein, and exercised the same. The Recommendation Statement at issue contains the unanimous recommendation of each of the Individual Defendants to approve the Proposed Transaction. They were, thus, directly involved in the making of this document.

128. In addition, as the Recommendation Statement sets forth at length, and as described herein, the Individual Defendants were each involved in negotiating, reviewing, and approving the Proposed Transaction. The Recommendation Statement purports to describe the various issues and information that the Individual Defendants reviewed and considered. The Individual Defendants participated in drafting and/or gave their input on the content of those descriptions.

129. By virtue of the foregoing, the Individual Defendants have violated Section 20(a) of the Exchange Act.

39

130. As set forth above, the Individual Defendants had the ability to exercise control over and did control a person or persons who have each violated Sections 14(e) and 14(d)(4) of the Exchange Act and Rule 14d-9, by their acts and omissions as alleged herein. By virtue of their positions as controlling persons, the Individual Defendants are liable pursuant to Section 20(a) of the Exchange Act. As a direct and proximate result of Individual Defendants’ conduct, Plaintiff will be irreparably harmed.

PRAYER FOR RELIEF

WHEREFORE, Plaintiff demands injunctive relief in her favor and in favor of the Class and against Defendants as follows:

A. Declaring that this action is properly maintainable as a Class action and certifying Plaintiff as Class representative;

B. Enjoining Defendants, their agents, counsel, employees and all persons acting in concert with them from consummating the Tender Offer, unless and until the Company discloses the material information identified above which has been omitted from the Recommendation Statement;

C. Rescinding, to the extent already implemented, the Proposed Transaction or any of the terms thereof, or granting Plaintiff and the Class rescissory damages;

D. Directing the Individual Defendants to account to Plaintiff and the Class for all damages suffered as a result of the Individual Defendants’ wrongdoing;

E. Awarding Plaintiff the costs and disbursements of this action, including reasonable attorneys’ and experts’ fees; and

40

F. Granting such other and further equitable relief as this Court may deem just and proper.

Dated: September 9, 2015

|

|

LOCAL COUNSEL |

|

|

|

|

|

/s/Roger Townsend |

|

|

Roger Townsend, WSBA # 25525 |

|

|

1000 Second Avenue, Suite 3670 |

|

|

Seattle, WA 98104 |

|

|

Phone (206) 652-8660 |

|

|

Fax (206) 652-8290 |

|

|

Rtownsend@bjtlegal.com |

|

|

|

|

|

OF COUNSEL: |

|

|

FARUQI & FARUQI, LLP |

|

|

Juan E. Monteverde |

|

|

369 Lexington Avenue, 10th Fl. |

|

|

New York, NY 10017 |

|

|

Tel.: (212) 983-9330 |

|

|

Fax: (212) 983-9331 |

|

|

Email: jmonteverde@faruqilaw.com |

|

|

|

|

|

OF COUNSEL: |

|

|

BRODSKY & SMITH |

|

|

Evan J. Smith |

|

|

Marc L. Ackerman |

|

|

Two Bala Plaza, Ste. 510 |

|

|

Bala Cynwyd, PA 19004 |

|

|

Email: esmith@brodsky-smith.com

mackerman@brodsky-smith.com |

|

|

|

|

|

Counsel for Plaintiff |

41

![]()